CHAPTER 13 BANKRUPTCY

CHAPTER 13 BANKRUPTCY

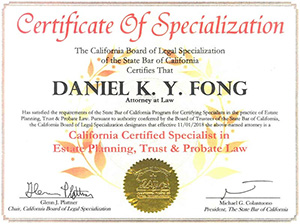

While many individuals look to Chapter 7 bankruptcy as a way to recover from financial hardship, other individuals need to use a Chapter 13 bankruptcy. If you are behind on your home payments, behind on your car or truck payments, you owe money to the IRS, you owe back child support payments, you owe on other assets you want to keep, or you owe on non-dischargeable debts, Chapter 13 offers the best way to restructure your obligations, recover from debt problems, and keep creditors from repossessing assets you want to keep. Further, if you do not qualify for Chapter 7 bankruptcy due to high income, Chapter 13 bankruptcy may be the best option for you to help restore financial order to your life. Contact Fong Law Group and we will help you determine if filing for Chapter 13 bankruptcy is right for you.

Unlike Chapter 7 bankruptcy, Chapter 13 bankruptcy requires you to make monthly payments to your creditors. How much you can afford beyond your normal living expenses will determine your monthly payments. Normal living expenses include your mortgage, car or truck payments, health insurance, food, clothing, and typical living expenses. A Chapter 13 plan is for a term of either 3 years or 5 years. At the end of the three or five year term, you will receive a discharge of any unpaid, unsecured debt, regardless of the amount paid by the Chapter 13 trustee to your creditors.

Chapter 13 allows you keep property that otherwise would have been liquidated under Chapter 7 bankruptcy. This means that Chapter 13 could allow you to keep your house, your car, and your business. If you are facing a foreclosure, this may be one good way to prevent losing your house.

Your monthly payments go to a Chapter 13 trustee who divides the payments among your creditors and makes the payments to them according to the bankruptcy plan. A Fong Law Group lawyer can give you more information about monthly payment plans under Chapter 13 bankruptcy. In many cases, the monthly payments are based on amounts owed for a house or a car.

Chapter 13 bankruptcy has other benefits as well. It protects you from the collection efforts of your creditors and helps end the lender harassment that you may have had to endure. After you have made timely payments to a Chapter 13 trustee for a period of time, your credit scores will generally increase. You will be able to rebuild your credit more quickly. When looking at California debt relief options, think about Chapter 13 bankruptcy because it brings these many benefits that can put you back on the path to financial freedom.

Contact Fong Law Group today, for a FREE CONSULTATION at 626-466-9728 who can help you determine whether Chapter 13 bankruptcy is an option for you.