CHAPTER 7 BANKRUPTCY

CHAPTER 7 BANKRUPTCY

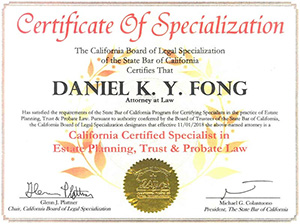

If you are facing overwhelming debt and considering bankruptcy, there are several options to understand. Of those options, Chapter 7 is the type of bankruptcy that allows an individual to discharge debts and move forward with a fresh start in a period of months. It can provide the quickest elimination of an individual’s debts. If you need the type of relief that Chapter 7 bankruptcy offers, contact Fong Law Group to get started.

Chapter 7 bankruptcy involves the liquidation of your non-exempt property (most people in California have very little, if any, non-exempt property) to pay your creditors and discharges your debts. Chapter 7 bankruptcy provides a “fresh start” for individuals trying to recover from debt.

Chapter 7 bankruptcy does not help with restructuring your house or car debts. If you are facing a foreclosure, a Fong Law Group attorney can help your understand which of your debts can be eliminated using Chapter 7 and whether or not it is the right option for you.

Changes made by Congress to the Bankruptcy Code in 2005 included significant changes to Chapter 7 bankruptcy. Filing a Chapter 7 bankruptcy is more difficult due to many added requirements. One of the most important changes was the “means test” which determines whether a debtor can file for bankruptcy under Chapter 7 or must file under Chapter 13 bankruptcy.

The Chapter 7 Means Test. The “means test” is one step used to determine whether an individual qualifies to file for Chapter 7 bankruptcy. The “means test” was implemented to address concerns of Congress with individuals with higher incomes filing Chapter 7 bankruptcies. However, the “means test” is only one of several steps used to evaluate whether an individual can file a Chapter 7 case. There are ways to qualify an individual for Chapter 7 who does not pass the means test, but you need an attorney who is actively involved in bankruptcy work and understands and knows the methods to qualify individuals for Chapter 7 cases.

If you cannot qualify for Chapter 7, you have the option to file under Chapter 13. For people who do not qualify for Chapter 7, a Chapter 13 case can be a very good solution. Chapter 13 does not mean that you must repay all of your creditors in full. Your payments in a Chapter 13 plan depend on many factors. An attorney who understands and knows the bankruptcy process can assist in structuring payments that are advantageous to you.

Contact Fong Law Group today, for a FREE CONSULTATION at 626-466-9728 who can help you determine whether Chapter 7 bankruptcy is an option for you.